A faster, more flexible way to access funding—whether you’re a growing startup or an established company.

Funding options that work for your business

Raise capital through proven structures delivered with innovative tech solutions

Unsecured Debt

Raise funds without collateral. A straightforward option for businesses with strong financials and growth plans.

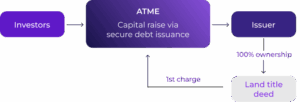

Secured Debt

Access funding backed by collateral such as real estate. Suitable for businesses who are seeking to optimize funding costs with their assets used as collateral.

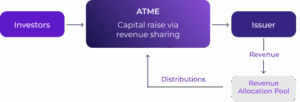

Revenue Sharing

Receive capital in exchange for a share of your top-line revenue, from one or multiple business lines. No fixed maturity.

Profit Sharing

Raise capital by sharing a portion of your bottom-line profit, across one or more business lines. No fixed maturity.

How do we make it happen?

Through tokenization: an approach that turns your real-world assets into digitally tradable securities fully compliant with the Central Bank of Bahrain’s regulations. It delivers:

1. Access to more investors

By splitting high-value assets into owenable fractions, you can attract a broader range of backers.

2. Easier trading

Tokens can be resold more easily, which helps create liquidity.

3. Built-in automation

Smart contracts handle payouts and track ownership, so there’s less room for error.

4. Faster turnaround

No waiting on paperwork or middlemen. Just a direct and streamlined process.

Why raise capital through tokenization?

Tokenization is already a massive market with institutional traction. Citi projects the tokenized private equity market will reach:

10

The next generation for markets, the next generation for securities, will be tokenization of securities.

Larry Fink

CEO of BlackRock

You can choose where your tokens are traded

We issue tokens on a private, permissioned blockchain built for compliance.

However, if your strategy calls for broader exposure, we can issue on public blockchains like Ethereum or Solana, giving you access to a global investor network.

What the process looks like

1. Sign up and complete KYC

Register on ATME and complete the standard identity and compliance checks – just like opening a bank account.

2. We analyze your business

We study your model and ensure everything aligns with investor protections.

3. Structure your offering

We work with you to create the most compatible legal structure.

4. Draft your whitepaper

We write this comprehensive document detailing all commercial and legal aspects of your offering and manage approvals with regulators.

5. Optional marketing support

We can help promote your offering through our network and develop marketing activities to reach potential investors.

6. Investor onboarding

We handle KYC and AML checks for your investors.

7. Go live

Your offering is published on our platform, ready for subscription.

8. Receive funds

Once the raise is complete, tokens go to investors, and you receive the capital amount.